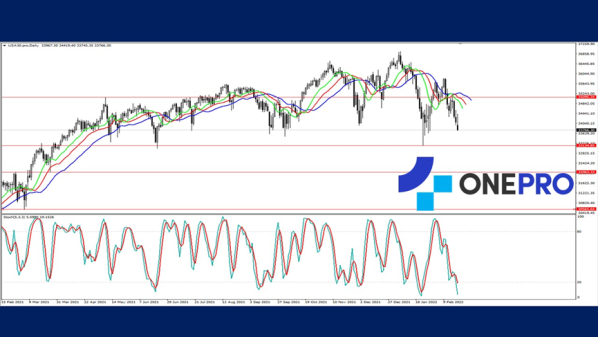

【Dow Jones Index USA30】

A White House spokeswoman said on Sunday that if Moscow authorities do not invade Ukraine in the coming days, U.S. President Joe Biden will hold a summit with Russian leaders after this week's meeting between the foreign ministers.

The Dow Jones index opened higher in the morning, but the market was again pressured in the late session. Recently, the Dow Jones Index has often staged a drama of opening high and going low and the index has continued to challenge the low of nearly a month.

The selling pressure on the short term is still very strong with the Alligator showing a death cross and KD showing a low-end figure.

Coupled with the recent unstable economic data, unstable international sentiment, and the large amount of capital flow in gold and crude oil and the withdrawal of funds in the stock market, it still looks unfavourable for the index.

USA30 –H4

Resistance 1: 33644 / Resistance 2: 34615 / Resistance 3: 34818

Support 1: 33136 / Support 2: 32063 / Support 3: 30565

【USOIL】

U.S. Secretary of State Blinken agreed to meet with Russian Foreign Minister Sergei Lavrov this week which calmed market tensions. The prospect of increased Iranian oil exports also eased supply concerns. Baker Hughes Inc, the world's third-largest oilfield services company, reported that as of Feb. 18, the number of U.S. oil and gas exploration wells increased by 10 to 645 from the previous week which is a new high since April 2020.

The U.S. Department of Energy reported this month on revising its estimate for average U.S. crude oil production in 2022 by 170,000 barrels per day to 11.97 million barrels from the previous month. Its 2023 average daily production estimate would be by 190,000 barrels to 12.6 million barrels. This will set a new annual high for average daily production and surpass the previous record high of 12.3 million barrels in 2019.

From the technical line, crude oil prices continue to oscillate at the high point. With the impact of the recent hostility in Ukraine and Russia huge, crude oil prices have received a lot of support from market funds. It is still difficult to see crude oil having a proper correction.

USOIL – D1

Resistance 1: 95.800 / Resistance 2: 98.000 / Resistance 3: 100.000

Support 1: 94.478 / Support 2: 91.147 / Support 3: 89.239

【XAUUSD】

Market rumours on the United States signalling to allies that Russia has issued military orders to attack Ukraine have been circulated. The French president has said that the United States and Russia will meet only if Russia has not yet invaded Ukraine.

Due to the strong atmosphere of war between Ukraine and Russia, investors in the market have also begun to pay attention as to whether the price of gold may have the possibility of investment profits. This resulted in gold being bought by more investors and causing a push in price.

SPDR Gold Shares, the world's largest gold-backed ETF, has increased its holdings by 50 tonnes since December 2021.

Looking at the price of gold from the technical line, the trend is getting closer to the historical high at $1916 per ounce. The price trend is still high and looks harder to drop below the low to break the upward trend. The short-term, medium-term, long-term moving averages still show a golden cross while the KD is also showing a golden cross. This indicates that the strength of buying at this stage is still quite strong.

XAUUSD – D1

Resistance 1: 1900.50 / Resistance 2: 1915.50

Support 1: 1880.80 / Support 2: 1853.50 / Support 3: 1833.00

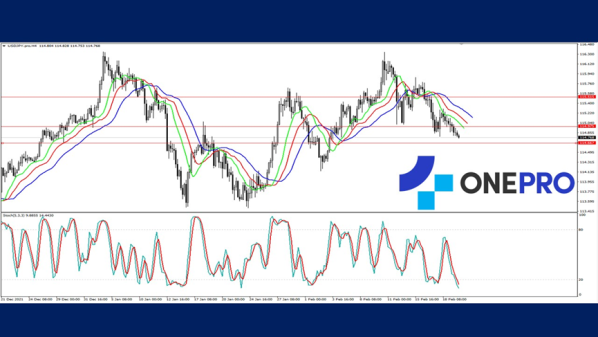

【USDJPY】

According to historical experience, the yen is often borrowed out to invest in goods from other countries. When the bloom begins to slow, investors will begin to repay debts, resulting in the appreciation of the yen.

Fitch's research team pointed out that according to historical experience, the yen tends to strengthen during this global trend lending period. The global economy has been decelerated at this stage and it is still expected that the global economy will slow further in 2023. Due to this, the Bank of Japan is expected to start to shrink its balance sheet, which will support the yen.

From the H4 technical line, Alligator shows a death cross and KD shows a low-end passivation due to the process of falling back from the highs. This indicates that investors have a stronger sentiment towards USDJPY selling in the near future.

USDJPY -H4

Resistance 1: 115.520 / Resistance 2: 116.350

Support 1: 114.800 / Support 2: 114.950 / Support 3: 114.680

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply