By: Damian Okonkwo

History of Forex Trading

The first Forex market is recorded to have been established in Amsterdam, roughly 500 years ago. It offered the opportunity to freely trade currencies which at this point helped to stabilize currency exchange rates. From Amsterdam, Forex trading spread throughout the whole world. Next in 1875, the Gold Standard was introduced.

The idea behind the formation of Forex Trading

The barter system which is seen as the oldest method of exchange dating back to 6000BC is often seen as the brain behind the formation of forex trading in later years. With the barter system goods were exchanged for other goods. The system later evolved and goods like animal hides and skin, salt and food spices which were in high demand then, became popular mediums of exchange. However, towards the 6th century BC, the first gold coins were produced, and they acted as a currency because they had such crucial characteristics like portability, durability, divisibility, uniformity, limited supply and acceptability which had today become the major characteristics of money.

At the tail end of the 18th century, most countries adopted the gold standard. The gold standard guaranteed that the government would redeem any amount of paper money for its value in gold. This worked fine until World War I where European countries had to suspend the gold standard to print more money to pay for the war. Hence the need for each country to develop their own a fiat currencies arose at this point and of course to buy goods and services from neighboring countries an exchange of currency was required and a standard too.

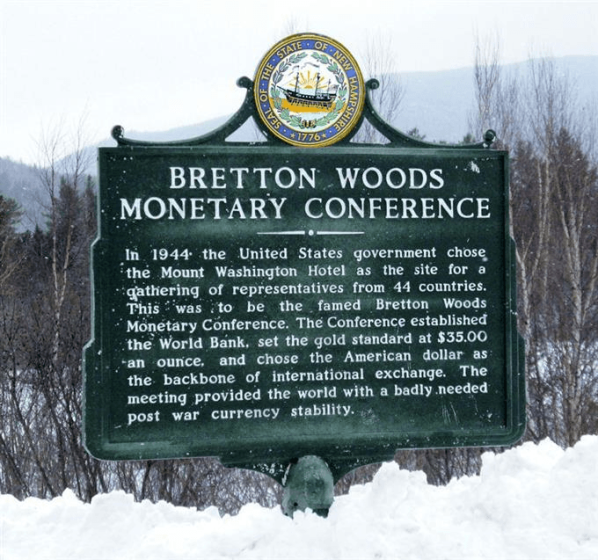

Formation of a standard for currency exchange vs the Bretton Woods System (1944 – 1971).

After the World War II, the United States, Great Britain, and France met at the United Nations Monetary and Financial Conference in Bretton Woods, NH to design a new global economic order. The location was chosen because at the time, the US was the only country not so much affected by war. Most of the major European countries were in shambles. The WWII transformed the US dollar from a failed currency after the stock market crash of 1929 to yardstick currency by which most other international currencies would subsequently be compared.

The major significance of the Bretton Woods Accord was that it crated a stable environment by which global economies could reorganize themselves. It achieved this by creating a flexible bottom line in the foreign exchange market by which other currencies were to be measured.

Subsequently other foreign countries were required to establish their exchange rate based on the relative exchange rate of the US Dollar to them. However, the US dollar could not subdue gold as it held the most gold reserves in the world at that time. Hence, they attached high importance to gold against the dollar exchange rate.

So following this Bretton conference, the foreign exchange market was established with US dollar as the standard exchange currency while gold remained a highly valuable precious metal for the store of values exchanging high above the US dollar.

History of Forex Trading in Nigeria

Forex Trading has a recent history in Nigeria. Thus the Nigerian foreign exchange market has witnessed tremendous changes. The Second-tier Foreign Exchange Market (SFEM) was introduced in September, 1986, the unified official market in 1987, the autonomous Foreign Exchange Market (AFEM) in 1995, and the Inter-bank Foreign Exchange Market (IFEM) in 1999. However, online forex trading spread in Nigeria only in 2010 when foreign brokers decided to extend their influence to Nigeria and finally fuelled by the pandemic it became so popular in Nigeria from 2019 till date.

Leave a Reply