【XAUUSD】

In the CPI consumer price index released by the US Department of Labor, prices rose by 7.5% as compared with the same period last year. This is higher than the market estimate of 7.2% and is the largest increase since 1982. Meat and eggs rose by more than 10%. The market believes that excessively bad inflation may make the Fed implement faster or more aggressive measures and this results in market volatility.

Although the price of gold has rebounded slightly, it is still in the range of triangular convergence. KD shows a golden cross while Alligator shows another golden cross. With a high-end figure, the strength of the buying is quite strong. However, the current triangular convergence has not yet been broken so investors should be patient to wait for the breakthrough of the convergence range for a clearer movement.

XAUUSD – D1

Resistance 1: 1814.50 / Resistance 2: 1832.20

Support 1: 1789.50 / Support 2: 1757.00 / Support 3: 1722.50

【EURUSD】

According to trade data released by the German Federal Statistical Office, it can be seen that Germany's trade balance in December 2021 was a surplus of 7 billion euros. This is less than the 11 billion euros expected by market experts.

In the past period, due to the tight global supply, Germany's most critical automotive industry encountered many difficulties in exports.

The euro is not volatile at this stage, but with the imperfection of the dollar CPI index, the euro once again challenges the recent consolidation range. The current EURUSD Alligator shows a golden cross while the KD shows a death cross. These two data contradict each other so this indicates there may be a need for new catalysts for the formation of a trend.

EURUSD– D1

Resistance 1: 1.14838 / Resistance 2: 1.15230 / Resistance 3: 1.16928

Support 1: 1.13880 / Support 2: 1.11900 / Support 3: 1.11203

【USDJPY】

The increase in labour hours required to buy the iPhone 13 in Japan shows that the purchasing power of Japanese people continues to decline. From the data, Japanese people currently need to work 72 hours to afford the iPhone 13. In Australia, it only takes 60 hours to afford it.

At this stage, the continuous depreciation of the Japanese currency and the continuous soaring prices of daily necessities has made Japan's economy slow and sluggish.

USDJPY once again challenged the recent new high. It showed that the depreciation of the Japanese currency has maintained a long-term trend. USDJPY is currently too high to break the previous day low and is challenging the band high.

USDJPY– D1

Resistance 1: 116.350

Support 1: 115.520 / Support 2: 114.950 / Support 3: 114.680

【BITCOIN】

Russia's central bank is working on a draft that sets cryptocurrencies as “money-like” to voluntarily declare cryptocurrencies when they are traded in excess of $8,000.

A few days ago, Russia has made it clear that it does not prohibit bitcoin trading or holding virtual currencies. However, it must be exchanged through banks or peer-to-peer exchanges that require government permission.

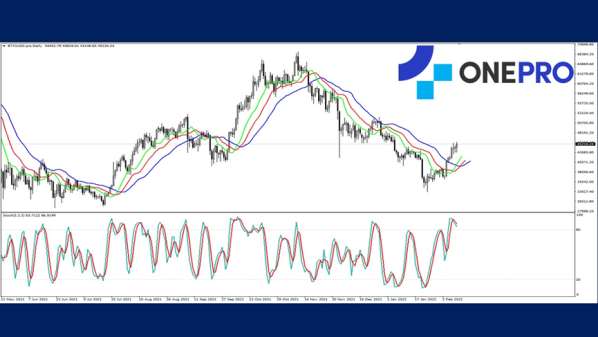

From a technical point of view, the recent Bitcoin W bottom began to rebound upwards. This drove the Alligator to a golden cross and KD a high-end figure. The short-term Bitcoin is loved by the market because the strength of buying is strong.

Coupled with the continuous deterioration of inflation in the United States, there are also many investors who are using Bitcoin as shelter.

BITCOIN – D1

Resistance 1: 39608 / Resistance 2: 41715 / Resistance 3: 45439

Support 1: 32965 / Support 2: 31019 / Support 3: 28976

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply