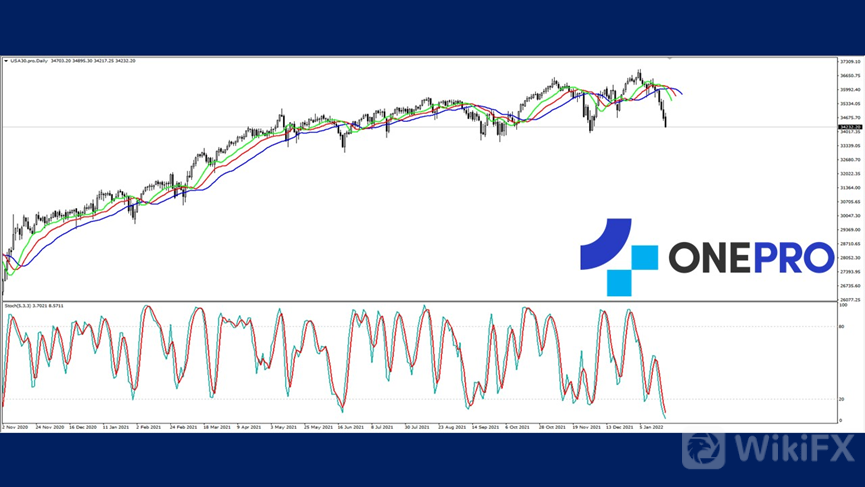

【Dow Jones Index USA30】

U.S. stocks fell for three straight weeks and was in the the worst weekly trend since 2020. From the highest point, it has been pulled back by nearly 8%. One of the most notable news was Netflix's earnings report that disappointed investors and plunging 21.79%. This was considered by investors to be one of the culprits that caused a heavy setback last Friday. From the technical line, it looks like the Dow Jones index has fallen near to the lowest point of the previous wave at 34022. Friday's closing price was at 34265 and if it continues to fall below, there is no support point below. At this stage, Allligator shows a death crossover while KD shows a low-end figure. These are strong conditions of a bearish trend so investors should not be optimistic about the market in the near future.

USA30 –D1

Resistance 1: 35635 / Resistance 2: 35768 / Resistance 3: 35941

Support 1: 34659/ Support 2: 34161/ Support 3: 33800

【EURUSD】

Germany's consumer price index rose by 5% in December compared to last year which was the highest figure ever recorded. ECB President Jarad believes that prices will rise mainly because of rising energy prices, and this problem will soon be alleviated. However, from the ECB's meeting, it is shown that the views of all the decision-makers in the European central bank are quite inconsistent. This is quite worrying about where the euro will go in the future. The technical line of the euro looks like an Alligator entangled together which indicates that the euro should continue to consolidate. The KD is also in a low-end figure but a casual rise can easily drive KD into a golden cross. Various indicators show that the euro should continue to consolidate and waiting for a clearer direction.

EURUSD – D1

Resistance 1: 1.14500 / Resistance 2: 1.14800 / Resistance 3: 1.15200

Support 1: 1.13800 / Support 2: 1.13500

【XAUUSD】

The price of gold in 2022 has always risen silently and it rose by 0.8% throughout the week. The closing price of gold was $1843 per ounce. As compared with the up-and-coming Bitcoin's bear, gold has stabilized a lot during this time. The Fed will hold their first interest rate decision in 2022 next week but gold investors have not made special arrangements as if they are still waiting for the news result. From the technical line point of view, the short, medium and long three moving average show a golden cross. The KD golden cross is also close to a high-end figure and that favours the buyers more.

XAUUSD – D1

Resistance 1: 1865.50 / Resistance 2: 1875.80

Support 1: 1832.20/ Support 2: 1814.50/ Support 3: 1789.50

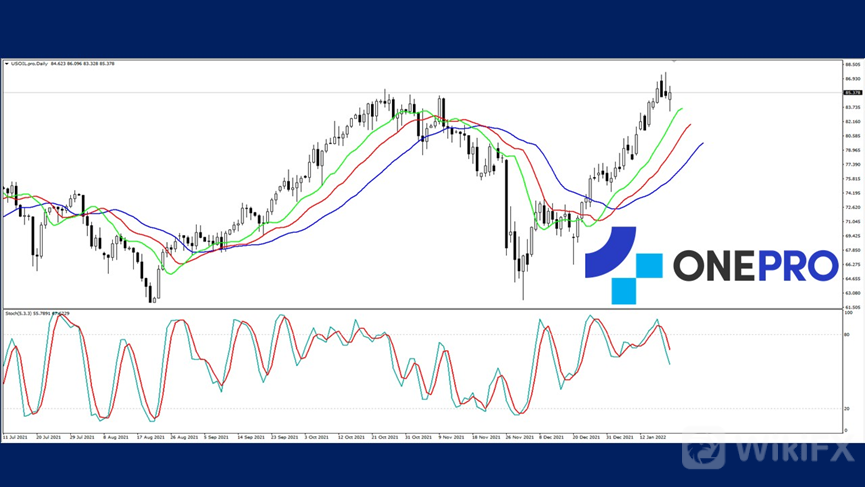

【USOIL】

In the Kingdom of Tonga in the South Pacific, unusually high waves, which authorities attribute to the eruption of Tonga‘s undersea volcano, caused an oil spill in Peru’s Pacific coast while a ship loaded oil at the La Pampilla refinery on Sunday. The Peruvian authorities issued an emergency order for environmental protection. The refinery where the accident occurred is a Spanish oil company, Repsol, to which the Peruvian government will seek compensation. Crude oil prices have continued to reach new highs recently, and analysts continue to be optimistic about the future of crude oil. The key lies in the problem of supply and demand. With the supply not fully improved, the prices are difficult to control.

USOIL – D1

Resistance 1: 87.180 / Resistance 2: 87.800

Support 1: 85.120/ Support 2: 82.800 / Support 3: 81.820

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply