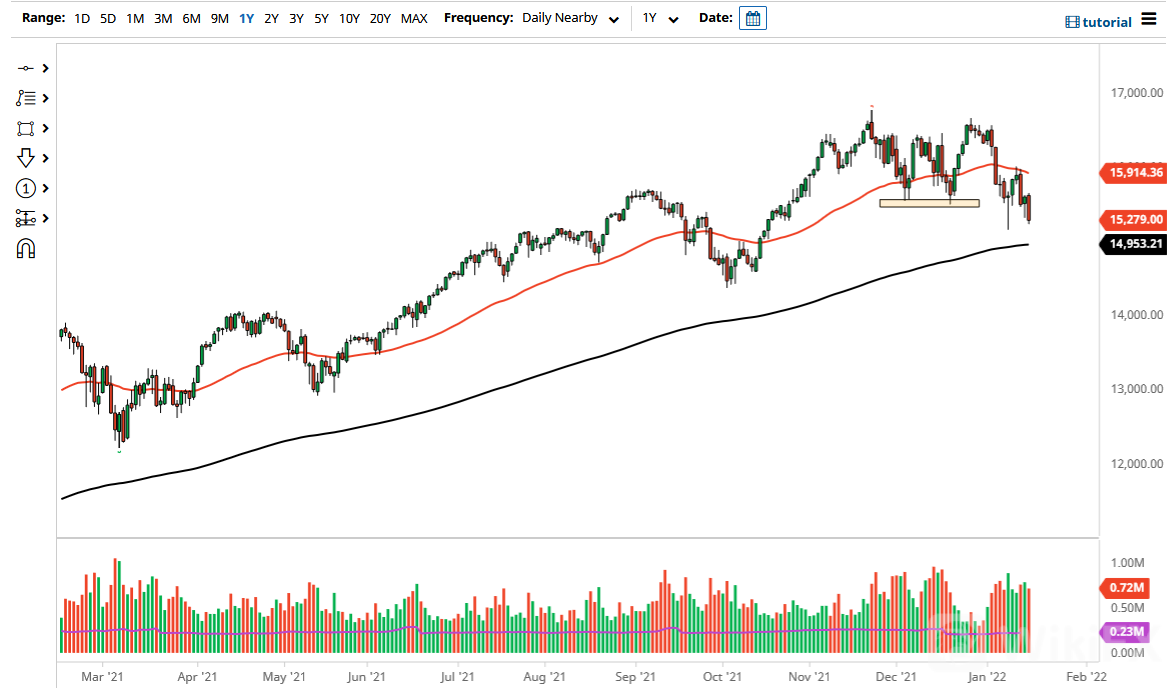

The NASDAQ 100 futures market broke down rather significantly on Tuesday to not only break the back of the hammer from the Friday session, but also the 15,500 level, an area that had previously been supportive. Because of this, the market is likely to continue seeing a lot of noisy behavior, so I would be cautious about trading this market at the moment. After all, interest rates skyrocketing in the United States has really freaked out a lot of technology traders, as well as a lot of the bigger companies that make up a huge portion of the movement in this index.

Remember, you are basically worried about Tesla, Microsoft, Google, Facebook, and a few others as far as where you go next. To think that there are actually 100 stocks that move this index with any type of significance is missing the point. At this point in time, it is all about large cap technology stocks and what they are doing. In other words, the typical “Wall Street darlings.” Ultimately, this is a market that only goes up over the longer term, so if we do break down from here, I will simply sit on the sidelines and wait for an opportunity to buy it at lower levels. The 15,000 level is a very important psychological area that could offer support that a lot of people would pay close attention to, as it is such a big figure. If we were to break down below there, then it is likely that we could see a situation where I might be a buyer of puts, but at this point I would not short this market due to the fact that we had seen so much in the way of outside interference by the Federal Reserve and several Wall Street firms. Ultimately, I like the idea of buying the dips, but we need to see some type of supportive action in order to put money to work. This could be a very dangerous place to be and frankly I am trading with very small positions. I would rather lose 0.1% on a trade based on noise than blow up an account. I think that is going to be the case for the immediate future in this market as well as many others.

Leave a Reply