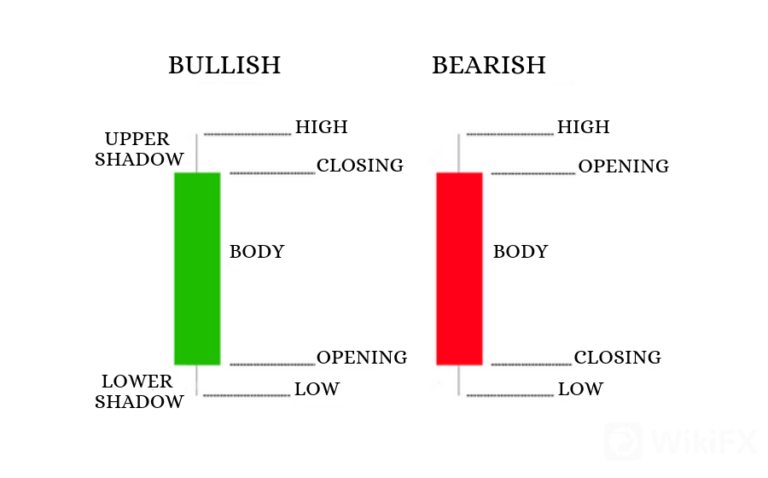

Each Japanese candlestick, like a bar on a price chart, shows price fluctuation over a historical moment in time, depending on the time frame of the price chart on which it appears. Each candlestick on a daily price chart, for example, indicates one day. The open, high, low, and closing prices of each candlestick are used to create it. The “true body” is the space between the open and close that is filled up horizontally with solid color. The candlestick is assigned a bullish hue when the closing is higher than the open (usually green or blue). The candlestick is tinted a bearish color when the closure is lower than the open (usually red).A vertical line continues upward from the genuine body of the candlestick to reach the highest point at which the price traded if the price went higher than the higher of the close or the open during the period when the candlestick was developing. A vertical line continues downward from the bottom of the actual body to the lowest point at which the price traded if the price moved lower than the lower of the close or the open during the period while the candlestick was developing.

With enough practice, you'll be able to see the story told by the movement of the previous ten or twenty candlesticks, which will make your analysis of the most recent one, two, or three candlesticks more powerful, because looking at the longer-term history will give you the context of what's going on now, which can be very helpful in determining whether the time is right to enter a long or short trade.

How to Interpret Candlestick Patterns in the Forex Market

Once you've mastered a few key candlestick patterns, you'll be anxious to apply them to your Forex trading. However, caution is advised because it is all too easy to become obsessed with discovering them and start looking for them everywhere, which may lead to overtrading. The greatest thing you can do is browse back over previous Forex price charts and seek for candlestick patterns that stand out. Could they have made a profitable transaction for you? Is there anything that all good candlestick setups have in common? You'll probably notice that the finest candlestick patterns were enormous, clear, and easy to read. Another crucial point to remember is that candlestick patterns that develop near major support and resistance levels, as well as extreme highs and lows, are far more likely to create profitable trades than patterns that emerge in the middle of nowhere.

The reverse candlestick patterns listed below are all reverse candlestick patterns that may indicate when the price is about to make a dramatic turn. If you can correctly predict these prospective reversals, you'll have entry locations for initiating trades with a favorable, profitable reward-to-risk ratio. These candlestick patterns can be used as continuation indications if they fail to produce a reversal and the price starts to move in the direction of the longer-term trend.

Conclusion

When these Forex candlestick patterns emerge on a live price chart, traders may use them in a variety of ways for trade entrances and exits. Before taking any action, the most conservative approach is to wait until the following candlestick closes. More aggressive traders will enter the trade as soon as the candlestick breaks to the upside or downside, but as you can see from the doji candlestick example above, this will put the trader in a whipsaw position. The trader would have been more certain that the bullish momentum had built up if he had waited till the closure.

Leave a Reply