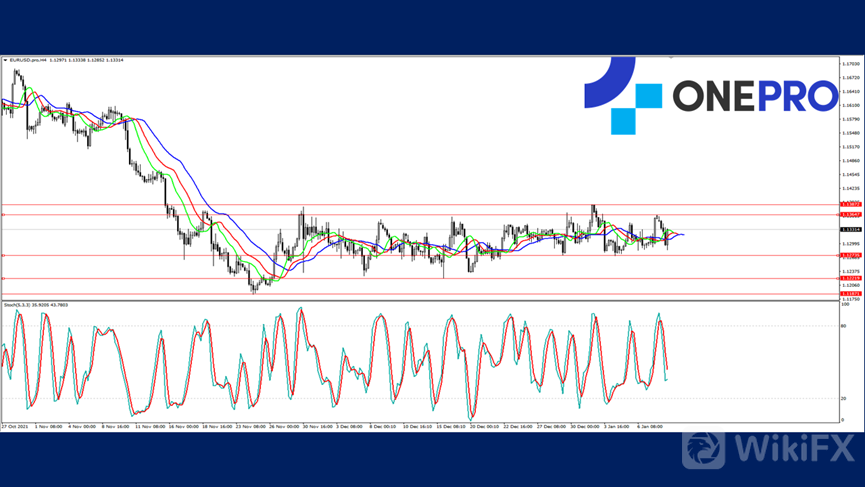

【EURUSD】

Eurostat announced on January 10 that the unemployment rate in the euro area fell to 7.2% in November 2021. The unemployment rate under the age of 25 fell to 15.5% and the number of unemployed people fell by 222,000. That is better than expected for the euro area.

The euro is still trading in the range and consolidating. There is no particularly large fluctuation.

In terms of technical lines, Alligator is still in tangles while the KD shows a death cross but converging. The market is still waiting for the emergence of a new burst as the euro is struggling to break out of its current situation.

EURUSD-H4

Resistance 1: 1.13500 / Resistance 2: 1.13800 / Resistance 3: 1.14500

Support 1: 1.12800 / Support 2: 1.12200 / Support 3: 1.11800

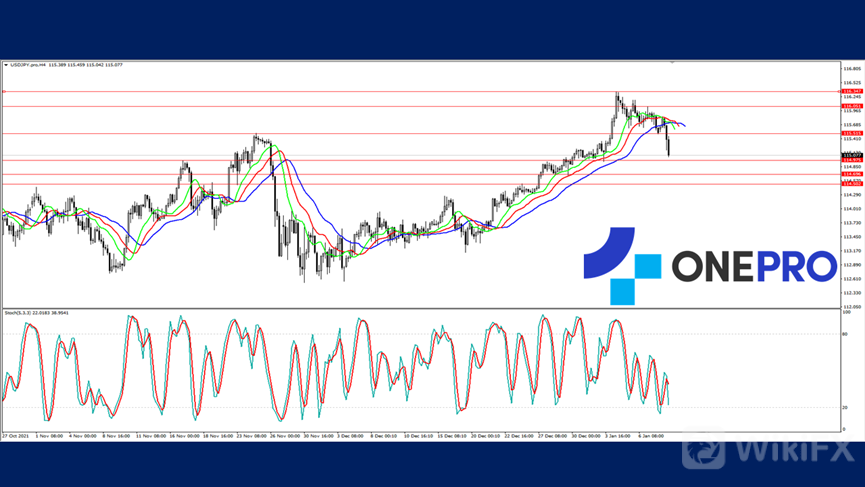

【USDJPY】

Japanese Finance Minister Shunichi Suzuki was focused on whether the yen's exchange rate would affect the economy as foreign exchange stability is important.

Before the Minister of Finance took office, he had expressed the favourable remarks that the depreciation of the Japanese currency would be beneficial to Japanese dealers and overseas companies. However, whether the recent collapse of the yen will make the Japanese finance minister make a different policy is worth investors watching.

After USDJPY hit a new high, it was slightly pulled back. The technical line of an Allligator death cross and KD death cross showed that the high-end profit selling pressure continued. The support has not been broken but it is still faced with a pull-back.

USDJPY -H4

Resistance 1: 115.520 / Resistance 2: 116.050 / Resistance 3: 116.350

Support 1: 114.950 / Support 2: 114.680 / Support 3: 113.150

【XAUUSD】

The World Gold Council report shows that global gold-backed ETF holdings fell by 6.4T, with gold-backed ETFs in North America falling by 21.6T but Asia increasing by 8.1T.

The report shows that in 2021, the North American market is expected to raise interest rates on the US dollar. Therefore, the market believes that the price of gold will be suppressed. With the current valuation of gold prices too high, the price of gold is expected to be boosted if the stock market is pulled back in the future.

In terms of the current technical analysis of gold, the Alligator and KD shows a death cross. The short-term decline was not small, but the current price of gold seems to have a mysterious attraction and continues to oscillate at this price of $1800 per ounce.

XAUUSD – H4

Resistance 1: 1814.50 / Resistance 2: 1832.20 / Resistance 3: 1865.50

Support 1: 1789.50 / Support 2: 1778.20 / Support 3: 1761.80

【BITCOIN】

Bitcoin's recent price trend has continued to decrease but has not tested the next support. The downward pattern was quite obvious and this is coupled with the recent fall below the previous support point of $41931.

Fortunately, at the previous low of $39,620, there was a large amount of support. There was a clear lower shadow that appeared on the chart, showing that there was buying intervention here.

From the technical lines, it is still a bearish pattern. The Alligator death cross and the KD golden cross are contradictory, but it is difficult to reverse the pattern in one movement.

BITCOIN – H4

Resistance 1: 41715 / Resistance 2: 45439 / Resistance 3: 48569

Support 1: 40664 / Support 2: 39500

OneProSpecial Analyst

Buy or sell or copy trade crypto CFDs atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply