【GBPUSD】

The latest research released by the British Ports Association shows that although the epidemic still breaks out from time to time, the UK is still investing more than a billion pounds in port infrastructure. That is expected to increase the capacity of container ports by 1/3. It shows that the British has improved in the pace of infrastructure construction, ensuring investors confidence in the investment of GBPUSD.

The technical line is still high to break the low. The pattern of the upward trend has not changed but the death cross of KD in the short term may have an impact on the upward trend. With the current uptrend of the pound, being cautious for the pullbacks of each wave is the most important thing investors want to take note at this stage.

GBPUSD-H4

Resistance 1: 1.35200 / Resistance 2: 1.35800

Support 1: 1.34780 / Support 2: 1.33750 / Support 3: 1.32780

【USOIL】

API's crude oil index shows a sharp decline in crude oil inventories by 6.432 million barrels. This is more than the market expected at 3.4 million barrels. The current demand for crude oil market has not decreased and this is something that can be expected for oil prices.

International crude oil prices have pulled up again in the short term and have reached the position of $78.4 per barrel of crude oil.

In terms of technical lines, crude oil is still on an uptrend and has not tested any lows. The rise in crude oil prices is nothing less than bad news for inflation. This means that if governments do not quickly adjust to monetary policy, the problem of inflation may continue to worsen.

USOIL-H4

Resistance 1: 77.550 / Resistance 2: 78.420 / Resistance 3: 79.850

Support 1: 74.120 / Support 2: 73.050 / Support 3: 71.202

【XAUUSD】

The trend of gold prices is still at a bullish pattern but tested yesterdays lows. Gold immediately stood back after a brief break below the price of $1800 per ounce and is currently oscillating at the price of 1824-1832 per ounce.

Coincidentally, all precious metal commodities and even oil quoted with the US dollar are bullish in the short term. This indicates that the dollar may continue to weaken until their interest rate policy is more aggressive, resulting in other commodities moving higher.

XAUUSD-H4

Resistance 1: 1814.50 / Resistance 2: 1832.20 / Resistance 3: 1865.50

Support 1: 1789.50 / Support 2: 1778.20 / Support 3: 1761.80

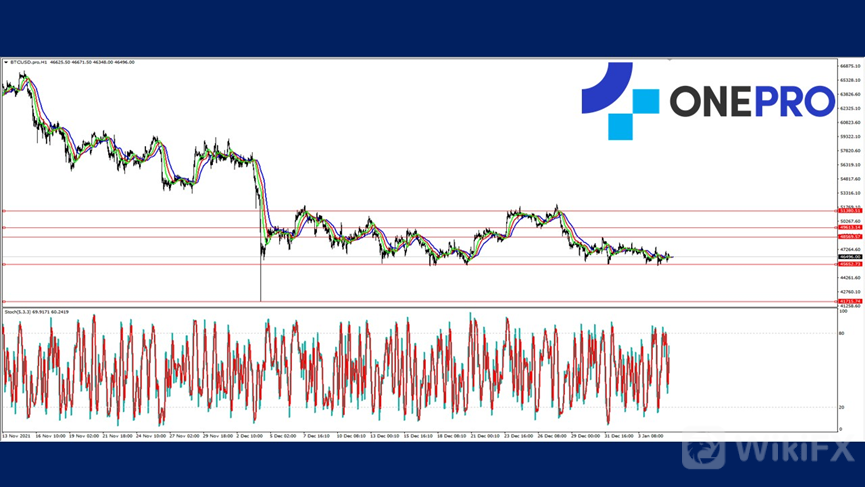

【BITCOIN】

Bitcoin is a commodity denominated in US dollars but has not risen or has been in the consolidation stage. Although Goldman Sachs analysts shouted to the market that digital assets will be more widely used in the future and that the reasonable price of bitcoin should rise to a $100,000, bitcoin has not been incentivized.

At this stage, many people do think that Bitcoin and gold have the same value of preservation but in the absence of supervision, the risk caused by volatility still makes many people hesitate.

BITCOIN-H4

Resistance 1: 48569 / Resistance 2: 50890 / Resistance 3: 52131

Support 1: 45439 / Support 2: 41715

OneProSpecial Analyst

Buy or sell or copy trade atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply