【EURUSD】

The eurozone manufacturing PMI hit a new ten-month low in December. This is coupled with the rise of the dollar index which caused the euro to fall below several support points.

As the EURUSD has been oscillating for a long time, each support and resistance figure is very close.

EURUSD is still oscillating between the 1.13500 to 1.12500 area currently.

From the opening of an Alligator golden cross figure to the narrowed figure and the death cross of KD to a reversal of 20 to 50, this indicates a contradictory situation. The market flows are still dominated by a consolidation strategy.

EURUSD-H4

Resistance 1: 1.13500 / Resistance 2: 1.13800 / Resistance 3: 1.14500

Support 1: 1.12500 / Support 2: 1.12200 / Support 3: 1.11800

【XAUUSD】

With the Chinese Lunar New Year coming, gold sales are bound to have a wave of buying.

In Beijing at the beginning of January every year, there will usually be many investors playing the traditional spirit of gift-giving.

With this year being the Year of the Tiger, there should be added demand for gold. In the long run, there are future inflationary matters which we do not know when it will be solved.

In the short term, the buying is strong, as central banks of various countries continue to reserve gold.

The rise in the Dollar has allowed gold to fall briefly and it is currently defending $1800 an ounce.

In terms of the technical line, it is still currently a bullish pattern that is high and has not broken the low. The KD indicator shows a low-level because of the downward movement.

This indicates that the trend and indicators are chaotic. Oscillated patterns may likely occur.

XAUUSD-H4

Resistance 1: 1814.50 / Resistance 2: 1832.20 / Resistance 3: 1865.50

Support 1: 1789.50 / Support 2: 1778.20 / Support 3: 1761.80

【USOIL】

Although the dollar index rose, crude oil rose more. The situation of crude oil shows a rising trend as investors feel that the follow-up to the crude oil shortage will not be not ideal.

Although Russia and the crude oil exporting countries organization meeting did not have a resolution announced, it is clear that the big houses has begun to make some trading flows.

In terms of the current technical line, Alligator is in a tangled state while the KD is showing a golden cross.

The influence of the golden cross is greater than a mixed figure and this shows that the buyer's strength is stronger.

USOIL-H4

Resistance 1: 77.550 / Resistance 2: 78.420 / Resistance 3: 79.850

Support 1: 74.120 / Support 2: 73.050 / Support 3: 71.202

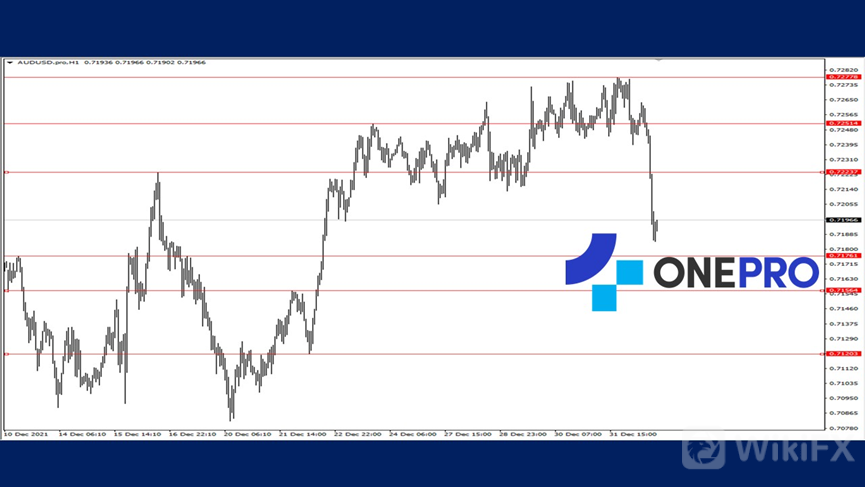

【AUDUSD】

The number of confirmed coronavirus cases in Australia for many consecutive days hit a new high.

The number of confirmed cases in a single day yesterday reached more than 30,000 but the Australian government believes that the Omicron's symptoms are mild so it is expected to restart the economic opening according to their original plan.

Basically, the AUDUSD fell under the influence of the rise in the US dollar. In the short-term, sharp declines in most technical indicators will become a death cross. However, with the speed of this decline too fast, it usually causes a short rebound which shows buying power in the support below.

AUDUSD-H1

Resistance 1: 0.72200 / Resistance 2: 0.72500 / Resistance 3: 0.72800

Support 1: 0.71800 / Support 2: 0.71500 / Support 3: 0.71200

OneProSpecial Analyst

Buy or sell or copy trade atwww.OneProglobal.com

The foregoing is a personal opinion only and does not represent any opinion ofOneProGlobal, nor is there any guarantee of reliability, accuracy or originality in the foregoing.

Forex and CFD trading may pose a risk to your invested capital.

Before making an investment decision, investors should consider their own circumstances to assess the risks of investment products. If necessary, consult a professional investment advisor.

www.oneproglobal.com

Leave a Reply