Gold appears ready to begin trading in the New Year above the 1800.00 level, but speculators have experienced a full taste of its volatility the past month and should expect more.

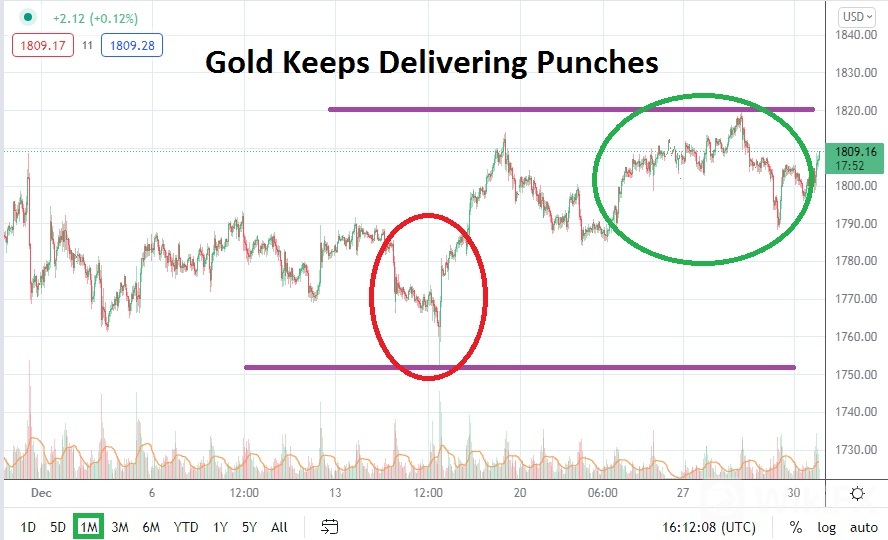

On the 15th of December, gold experienced another swift leg down and suddenly touched the 1754.00 level briefly. This kick downwards came after gold finished off the month of November with a decline which continued into the middle of December. The price of gold at its height in November was a rather healthy value near 1875.00, but it could not be sustained.

While technical traders contemplate short and mid-term trends of the precious metal, it is certain some fundamentals also were a factor in the price of gold. However, it may actually be tough as a fundamental trader to try and explain the price range of gold displayed in December. The precious metal did not produce a huge jump in value when news about the Omicron variant began to make headlines. Yes, it moved to a high on nearly 1810.00 approximately in the last week of November, which was a move higher, but nervousness really did not break any major price ranges.

Then, in the middle of December, the price of gold took a sudden turn lower and looked like it might threaten lows seen in October and perhaps even September, but that did not happen. Gold actually began to recover in price value after touching its mid-December lows, but its rise has been demonstrated with a solid amount of choppy results. And the past few days of trading have produced a climb higher, and since around the 21st of December gold has been challenging the 1800.00 juncture, but not been able to produce an overwhelming climb above the important psychological value. The price of 1800.00 seems to be a constant reflection, an inflection point still.

As January gets started, it appears gold remains a speculative commodity that has not received a massive wave of short-term proponents. There doesnt seem to be a sudden wave of buyers bursting onto the scenes because of fears of inflation, which have proven all too real in the global economic picture. Instead gold continues to suffer a rather intriguing price range which produces sharp reversals and punches.

Gold Outlook for January

Speculative price range for gold is 1757.00 to 1879.00.

If gold manages to maintain its stance above 1800.00 and actually shows the ability to trade above the 1810.00 mark, this could be a sign more bullish behavior could develop. However, gold has not shown a stark and powerful ability to maintain its higher values. If gold drops below the 1800.00 mark, the precious metal could certainly begin to challenge support near the 1790.00 and 1785.00 marks. If the ratio of 1785.00 is proven vulnerable it is conceivable that gold could once again hit the 1775.00 to 1770.00 levels and below.

While some fundamental traders may have a long term view of gold rising in value which could be proven correct, short-term traders need to pay attention to the quick trends which continue to affect the price of the commodity. If the major equity indices globally continue to flirt with higher realms, the potential of speculative buying in gold could remain hesitant, even if that is possible long term mistake.

If gold is able to keep its values above current market price and enter 2022 with a glimmer of shine, it is possible more buyers could eyes buying positions. The 1810.00 to 1820.00 levels should be watched by optimistic bulls. If the 1820.00 level begins to see a challenge, it is possible higher values could soon follow. Gold moving towards highs of 1830.00 and 1840.00 are definitely possible. However a catalyst cast by nervousness in the global markets may have to create sentiment which would ignite stronger buying trends.

Leave a Reply