The continued decline of the US dollar still supports gold bulls in moving higher. The price of gold is stable around the level of $1813 as of this writing, its highest in over a month. Trading in narrow ranges in light of the Christmas holidays and the reluctance of investors to venture cause poor liquidity in the markets in general. Gold held steady as year-end optimism helped push US stocks to a new record high, as traders bet that global economic recovery could beat risks from omicron and monetary policy tightening.

The S&P 500 had a record close of 69 this year, led by the energy and technology sectors, although volumes were below average. While the highly transmissible omicron variant is spreading rapidly around the world, studies show that disease caused by the new strain is not as severe as previous waves.

Bullion heads for its first annual loss in three years as global central banks begin to roll back pandemic-era stimulus to contain inflation, while investors also watch the threat omicron poses to economic activity. The United Kingdom said it will not impose stricter restrictions on Covid-19 in England before the end of the year despite the increase in cases, while the United States has reduced the recommended isolation time for Americans infected with the virus to five days from 10 days.

The price of gold is down about 5% this year. The Bloomberg dollar index changed slightly, while silver, platinum and palladium were down. Copper futures fell after closing at a two-month high on Monday.

Flight cancellations that disrupted holiday travel extended into Monday as airlines canceled more than 1,000 US flights because their crews were sick with the COVID-19 virus during one of the busiest travel times of the year, and storm fronts added to the chaos. Flight delays and cancellations linked to staff shortages have been common this year. Where airlines encouraged workers to quit in 2020, when air travel collapsed, and airlines struggled to make up for that this year, when air travel rebounded faster than almost anyone expected. The arrival of the omicron variable exacerbated the problem.

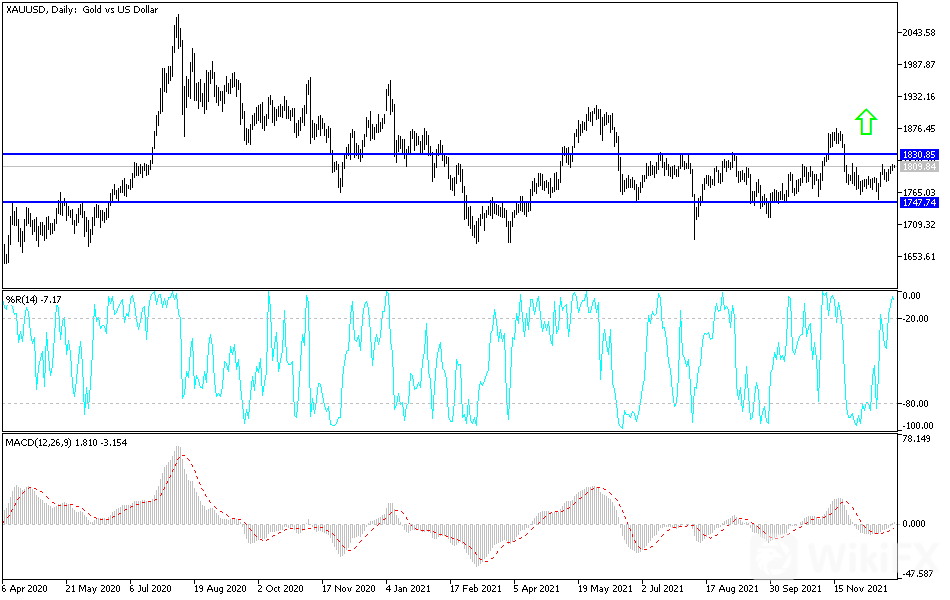

Technical Analysis

As I mentioned before, the stability of gold will remain above the psychological resistance of $1800, supporting the bullish momentum and a move to the resistance levels of 1818, 1827 and 1845, which will be the next targets for the bulls. On the downside, and according to the performance on the daily chart, the $1775 support level will remain vital for the bears to control and change the current bullish outlook. Bear in mind that the narrow movement in prices may remain until the end of the Christmas and New Year holidays.

Leave a Reply