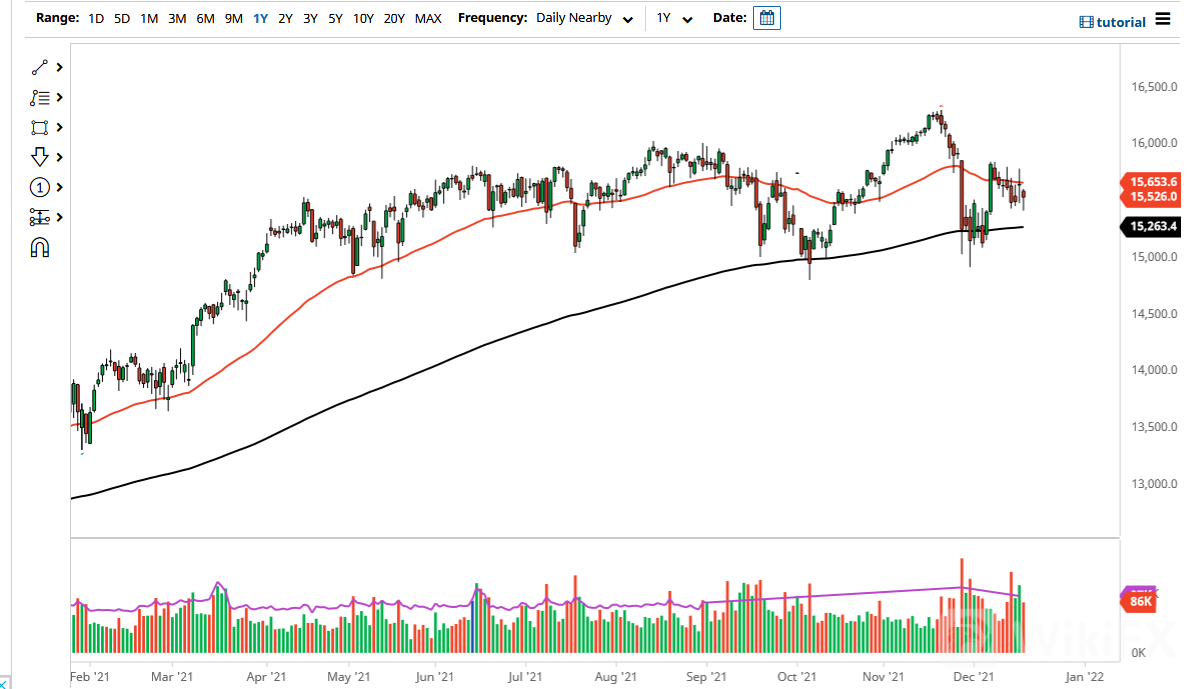

The DAX Index fell on Friday to reach down just below the €15,400 level. This is an area that has been supportive more than once, so it is not a huge surprise to see that we have turned around to form a bit of a hammer. In fact, the market looks as if it is going to settle into a relatively tight range, perhaps between the aforementioned €15,400 level on the bottom, and the €15,800 level on the top.

This would make a lot of sense considering we are heading into Christmas week, and most traders will not be worried about the markets in that type of situation. Most traders have already come and gone when it comes to what they are going to do for the year, so now it just simply a matter of collecting profits. It is possible that the lack of catalysts out there will come into the picture as well, simply allowing the market to drift back and forth in this €400 range.

This does present an interesting opportunity though, because if we do find ourselves sticking to this pattern, range-bound traders will have a field day. Granted, you never know if the range is going to break or when significant news will come over the wire, so this does not necessarily mean that you should lever up a huge position every time it gets close to the outside of the rectangle. For that matter, we may just simply slide out of this range and go into another one.

At this point, the €400 range that we are in at the moment is pretty much a microcosm for what has been going on in the DAX for a while. We are just simply going back and forth and trying to figure out where to go next. There is a whole slew of issues when it comes to Germany, not the least of which is that they have major issues with energy, while at the same time doing everything they can to lock down their economy due to the omicron variant. It is a difficult situation to see a lot of growth, and quite frankly Germany is on the verge of a recession. Having said that, traders always try to figure out what is going to happen in six months, not right now, so it is possible that we are still seeing a lot of risk being taken occasionally based upon forecasts.

Leave a Reply