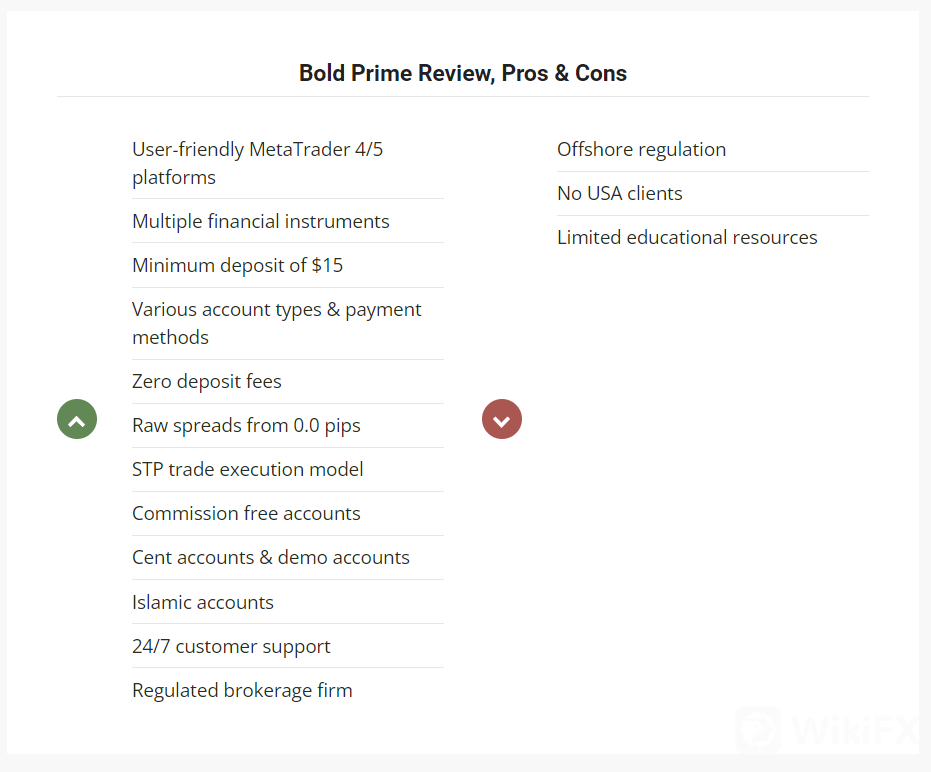

Bold Prime is an online financial services provider that offers a good selection of CFD instruments for trading online including forex, stocks and cryptocurrencies. They provide traders with the popular MT4 and MT5 trading platforms, which are easy to use and available in desktop, web, and mobile versions. There are multiple trading account types to choose from, with a minimum deposit requirement of just $15. The maximum leverage available is 1:1000, while you can choose between commission free accounts or get raw spreads from as low as 0.0 pips with a small commission fee of $7 per standard lot. Free demo accounts are available should you wish to practice trading online with virtual funds before opening a real account.

In this detailed Bold Prime review, our online broker research team has covered some of the most important aspects for you to consider when choosing the best broker for your online trading needs.

Bold Prime Overview

Bold Prime is a CFD Brokerage firm located in Mauritius, providing institutional level performance and technology with retail-like accessibility. The broker was launched in 2020 when several teams of experts in multiple sectors of the financial services industry collaborated to create an amalgamation of all the features, perks, and performance of industry-standard retail financial businesses.

In addition to very good trading conditions, they provide traders with some learning resources and a competent client support team who are available 24/7 to answer any of your questions. You can choose between various convenient account deposit and withdrawal methods, with zero deposit fees. Bold Prime welcome all trading styles, including scalping, hedging, news trading and automated trading via expert advisors.

Bold Prime Regulation

Bold Prime is a brand name of OPTIM Investments Limited who are authorised and regulated by Financial Services Commission of Mauritius (FSC) and is authorized to provide licensed services as an Investment Dealer and is authorized to administer client funds.

Using a regulated brokerage firm can help give investors the peace of mind that they are with a company who must follow strict rules and regulations that are put in place to protect investors. Bold Prime state that they abide by all procedures and hold client funds in segregated accounts so that they are not used for any other purposes.

Bold Prime Countries

Traders from different parts of the globe can open an account with Bold Prime, provided that doing so would not be contrary to local laws or regulations. However, the broker does not accept clients from the following countries: the U.S.A, Canada, Israel, New Zealand, Japan, and Islamic Iran.

Some Bold Prime features and products mentioned within this Bold Prime review may not be available to traders from certain countries because of legal restrictions.

Bold Prime Platforms

MetaTrader

Bold Prime provides its clients with access to the award-winning MetaTrader trading platforms — MT4 and MT5. Due to their ease-of-use, feature-rich climate, and automated trading capabilities, these platforms have grown to become the world‘s most common trading platforms for forex traders. They have evolved from a trading site to a global ecosystem where technology providers’ advances meet the needs of traders. In addition, the MT4 and MT5 trading platforms are replete with valuable trading tools to help take your trading to the next stage. The MT4 and MT5 trading platforms are available as desktop applications for Windows and Mac computers, web versions, and mobile apps for smartphone devices running on Android and iOS.

MetaTrader 4 vs MetaTrader 5

The latter launched MetaTrader5, is not that much different from its predecessor MT4, even though you would think it is substantially more advanced. The additional features that you will find are: more advanced trading charting systems as well as a larger choice of deep analytical tools. Even though the MT4 should be more than enough of a platform for the average forex trader, if these two functions will improve your trading skills and experience, then MT5 may be the preferred way to trade. However, MT4 is still the most widely used and downloaded platform and traders all over the world are continuously satisfied with its current abilities, hence not always feeling the need to switch over to MT5.

MetaTrader Features

-

Manage orders, positions and equity online

-

All order types and execution modes

-

Monitoring of financial instruments prices and forex rates

-

Advanced charting and indicators

-

Online streaming news

-

Explanatory Activity Reports

-

Automated trading with expert advisors

-

Strategy tester to back test trading robots

-

Choose from different chart types and timeframes

-

Get price alert notification sent by SMS, email and via platform

-

Web, desktop and mobile apps available for free

Bold Prime Trading Tools

There is currently no standalone trading tool on the brokers website, however traders can make do with the built-in tools of the provided trading platforms. This should be more than enough to meet the demands of even the most advanced traders. You can also get additional tools for the MetaTrader platform from the MQL marketplace within the platform and choose from thousands of free and paid platform tools available from many websites. Whatever your trading style, there is likely going to be a tool that can do what you want it to do. If not, there is the MQL programming interface where you can design your own customised tools or even pay a professional coder to do it for you.

Bold Prime Education

There is a limited selection of educational resources on the brokers website. However, there are few learning articles and trading guides to aid traders. This is an area in which Bold Prime could make significant improvements by preparing a complete trading course to help beginners learn the markets. The addition of video tutorials for the platforms would also be great. That being said, you can find a plethora of free trading education online whilst a demo trading account can be a great way to improve your trading skills and knowledge.

Bold Prime Instruments

The broker offers access to the following financial markets: forex, stocks, cryptocurrencies, and CFDs. When you trade CFD with Bold Prime, you can speculate long or short on the price of the underlying asset without actually needing to physically own it. The difference in price between when you enter and exit the CFD position is the profit or loss, minus any applicable broker fees such as the spread and commission. Generally speaking, they have a good choice of trading instruments with something for everyone, regardless of your interests.

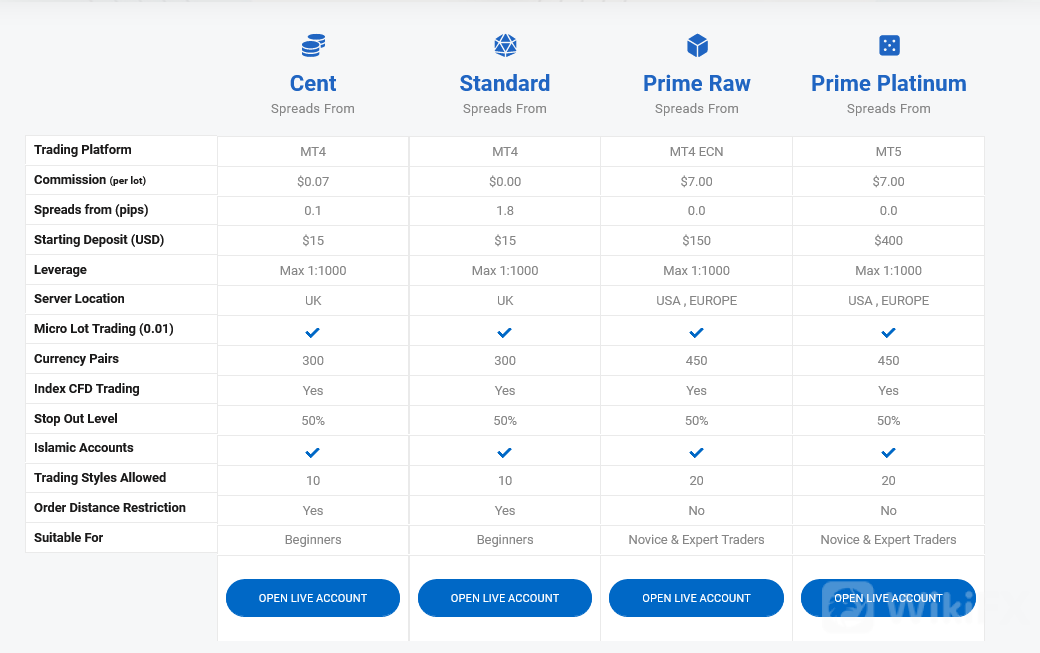

Bold Prime Accounts & Fees

The broker offers the following live trading account options: Prime Cent, Prime Standard ($15), Prime Raw ($150), and Prime Platinum ($150) accounts. All accounts have a maximum leverage of 1:100. Whilst leverage does allow you to trade a greater position size and boost potential profits, do keep in mind that it can also significantly increase your potential loss.

The account type that you choose may depend on your trading strategy. If you need spreads as low as possible, then you may want to look at the prime raw and prime platinum accounts that have spreads from just 0.0 pips. On the other hand, if you are new to trading online and just want to test your trading strategy with a minimal investment in a real live trading environment, there is the prime cent account.

Demo accounts are also available for practice purposes whilst the broker supports Muslim traders with the option of swap-free Islamic accounts for each account type.

Prime Cent Account

-

Commission (per lot) $0.07

-

Spreads From 0.1

-

Minimum deposit $15

Prime Standard Account

-

Commission (per lot) $0.00

-

Spreads From 1.8

-

Minimum deposit $15

Prime Raw Account

-

Commission (per lot) $7.00

-

Spreads From 0.0

-

Minimum deposit $150

Prime Platinum Account

-

Commission (per lot) $7.00

-

Spreads From 0.0

-

Minimum deposit $400

Demo Account

If you havent traded online before, you may want to start with a demo account. These accounts can be opened completely free of charge and come preloaded with virtual funds. This allows you to experience online trading without any risks involved. If and when you are ready, you can choose to switch over to a real account.

Islamic Account

The Bold Prime Islamic account option is available on all account types and complies with Sharia law. This enables Muslim traders to use the broker as there are no swap-fees on these accounts. There may however be other fees to compensate for the lack of swap.

As broker fees can vary and change, there may be additional fees that are not listed in this Bold Prime review. It is imperative to ensure that you check and understand all of the latest information before you open a Bold Prime broker account for online trading.

Bold Prime Support

Bold Prime provides traders with a knowledgeable client support team who have experience in the markets and are available 24/7 to respond to clients general, technical, and account-related inquiries. The support team can be reached via email, Live Chat, online form, telephone, or by visiting their physical office.

It is great to see a broker that offers around the clock support, especially via live chat which can be a very quick and easy way to get in touch. This means that wherever you are in the world and whatever your time zone, there should always be someone ready to answer your request in a sufficient manner.

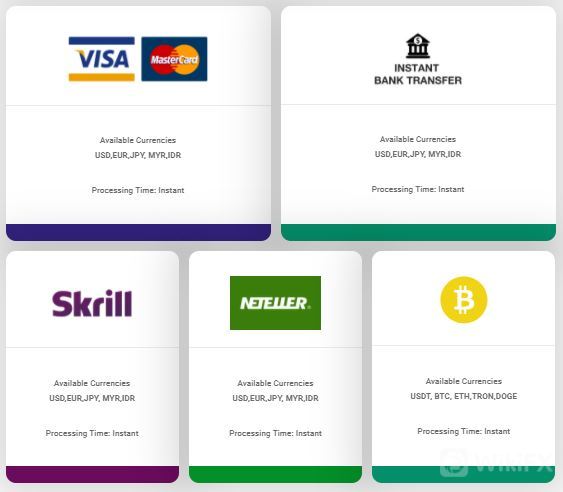

Bold Prime Deposit & Withdrawal

Bold Prime have a diverse selection of account payment options. It is always good to see a broker who offers something other than traditional methods of payment such as bank transfer. There are instantaneous deposits and fast withdrawals with zero commission fees.

The following payment methods are accepted for both account deposit and withdrawal purposes:

-

Bank transfer

-

Credit/ Debit cards, such as MasterCard and Visa

-

Online payment gateways: Neteller and Skrill

-

Cryptocurrency: Bitcoin

The time it takes for funds to land will depend on the payment option that you choose. There are no deposit or withdrawal fees charged by the broker, but you should check to see if your banking institution or online payment processor will charge you any fees. Accepted payment currencies include USD, EUR, JPY, MYR, IDR. If you use another currency, you may need to pay a currency conversion fee.

Leave a Reply