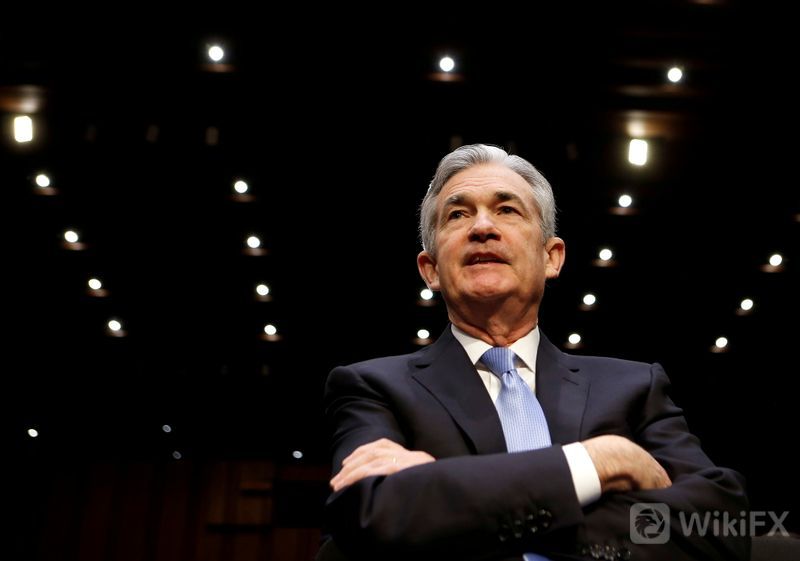

U.S. Federal Reserve Chair Jerome Powell on Monday said he continues to expect inflation to recede over the next year as supply and demand come into better balance, but warned that the new strain of COVID-19 muddies the outlook, and prices could continue to rise for longer than earlier thought.

“It is difficult to predict the persistence and effects of supply constraints, but it now appears that factors pushing inflation upward will linger well into next year,” Powell said in testimony prepared for delivery Tuesday at the U.S. Senate Banking Committee, and released Monday by the Fed.

The economy continues to strengthen, and the labor market to improve, pushing up wages, he said.

But the recent rise in COVID-19 cases and the emergence of the new Omicron variant “pose downside risks to employment and economic activity and increased uncertainty for inflation,” he said, noting that health-related concerns could “reduce people's willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.”

The Fed this month began reducing its support for the economy by gradually decreasing its asset purchases at a pace that would end them by next June.

But with inflation registering more than double the Fed's 2% target, Fed officials have increasingly said they are open to potentially speeding up the taper to clear the way for earlier interest rate hikes if needed.

Powell did not mention the taper timeline in his prepared remarks, though he did say the labor market has “ground to cover” before reaching full employment, one of the conditions the Fed has set before it will consider raising interest rates from their current near-zero levels.

The Fed, Powell promised, “is committed to our price-stability goal” and will use its tools both to support the economy and the labor market and to “prevent higher inflation from becoming entrenched.”

For more Forex news, please download WikiFX- the Global Forex Regulatory Inquiry APP.

Leave a Reply