NEW ZEALAND DOLLAR, NZD/USD, BUSINESS PMI, RBNZ, ECONOMY – TALKING POINTS

FRIDAY‘S ASIA-PACIFIC FORECAST

The New Zealand Dollar continued to move lower in overnight trading, extending the prior days’ dismal performance. NZD/USD is tracking a weekly loss near 1.5%, which was accelerated after the US Dollar‘s CPI-charged surge. The US Dollar remains on a path higher moving into Friday’s Asia-Pacific sessions, although upside momentum appears to be cooling off. That may allow the Kiwi Dollar to gain a foothold for a recovery going into the weekend.

A rebound on Wall Street bodes well for risk sentiment to close the week out in Asian equity markets. Today will bring consumer inflation expectations out of Australia for November. A rise over October‘s 3.6% figure may spark additional inflationary concerns in the domestic economy, which could help bolster RBA tightening bets. Still, yesterday’s jobs report has put a dovish spin on the central banks path forward.

New Zealand‘s performance of manufacturing index (BNZ) crossed the wires this morning at 54.3 for October. That is an increase from the upwardly revised September figure of 51.6. The improving conditions follow the rollback of Covid restrictions across much of the Kiwi economy. Next week’s services PSI reading will have traders looking for confirmation of the upbeat conditions in the economy.

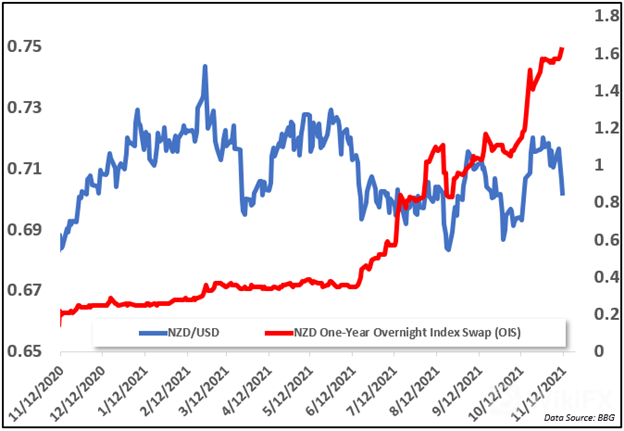

The Reserve Bank of New Zealand has plenty of ammunition to continue down the path of hiking rates, unlike its cross-Tasman counterpart, the RBA. This gives the New Zealand Dollar a comparative advantage versus the Australian Dollar. NZD rate hike bets have increased in recent weeks while the currencys performance has lagged against the Greenback (see chart below). That opens the door for a break higher in NZD/USD on the next bout of USD weakness.

NZD/USD TECHNICAL FORECAST

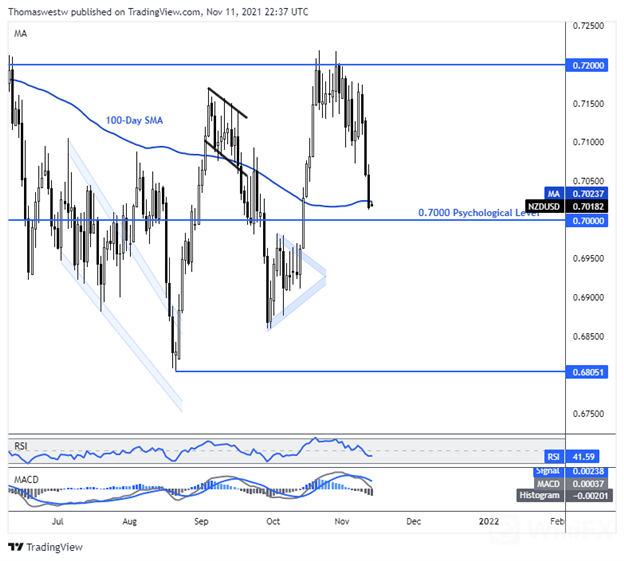

NZD/USD broke below its 100-day Simple Moving Average (SMA) overnight. Prices are clinging to that level in early APAC trading. A clean break lower will see the 0.7000 psychological level shift into focus. The MACD line is eyeing a cross below the oscillators center line, a bearish signal. If bulls manage to bring prices back above the 100-day SMA, a deeper selloff will likely be avoided.

NZD/USD DAILY CHART

Source: DailyFX

Leave a Reply