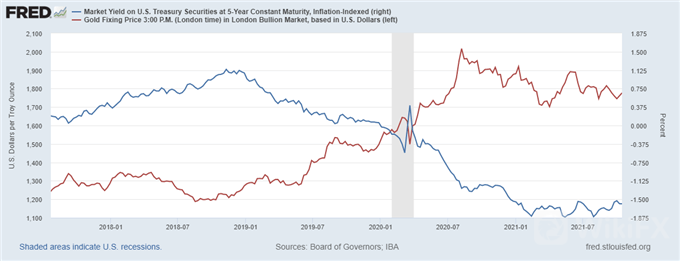

Gold prices appear rudderless, stalling near the middle of the range that has prevailed since a pointedly hawkish turn in Fed policy guidance in June marked major selloff. This statis might reflect a similarly non-committal showing from real interest rates (see chart below).

Observed inflation as well as price growth expectations have roared higher, and Fed rate hike bets have followed suit. The markets seem unclear on which side of the real-rate calculus will outpace the other however. Sub-zero real yields are a boon for non-interest-bearing gold: a rate of 0% is better than a negative one on cash.

If the Fed lags the inflationary surge, real rates will remain negative and gold will be underpinned. On the other hand, if tightening picks up steam just as inflation stalls – be that as global growth normalizes from post-Covid excesses or supply chains are mended – the yellow metal will be pressured lower.

Solving this puzzle is probably not in scope in the immediate term. The FOMC policy announcement due November 3 is probably the next major inflection point in the narrative. The central bank might formally announce its plans to taper QE asset purchases at that time, shaping bets on rate hikes to follow.

For now, the Fed Beige Book survey of regional economic conditions may take top billing. If it suggests that rising inflation expectations are undermining growth as spending plans are shelved to buffer against cost pressures ahead, tightening bets may firm and gold might swing lower.

The flow of third-quarter earnings releases is another consideration. The report from international freight giant CSX Corp may be of particular note considering supply chain gaps have been instrumental in driving the inflationary spike. If it envisions lasting bottlenecks that beckon Fed action, bullion may suffer.

GOLD TECHNICAL ANALYSIS – TREND BIAS BEARISH AMID SIDEWAYS DRIFT

Gold prices continue to vacillate below the $1800/oz figure. The overall downtrend in play since August 2020 remains firmly intact however. That speaks to a broadly bearish bias and painting current action as digestive along the way to deeper losses.

Initial support is anchored at 1750.78, with a break below that eyeing 1717.89 along the way to the major 2021 floor below the $1700/oz mark. Resistance begins at 1808.16, followed by the range top at 1834.14. A daily close above the latter level seems necessary to make the case for lasting upside follow-through.

Leave a Reply